The tourism tax which came into effect in September last year charges a flat rate of RM10 per room per night for foreigners who stay at hotels of all classes. One-off payment of RM600 and personal income tax relief of RM1000 on expenditure related to domestic tourism until December 2021.

How To Check If Your Hotel Stay Is Eligible For The Tourism Tax Relief

The Value-Added Tax or VAT in the European Union China and many other countries is a general broadly based consumption tax assessed on the value added to goods and services.

. Effective 1 September 2017 foreign nationals who stay at an accommodation premise in Malaysia are subject to a tourism tax of RM10 per room per night. For resident companies not included in the list given below. Extend the moratorium on loan repayments.

This allows the government to profit from any type of economic activity while at the same time standardizing the industry to benefit all the players involved. Airbnb doesnt do that math for you. Deductions can help bring down that amount.

20 income tax 153 self-employment tax 353 total tax rate times 20K. In Japan there is a similar tax called the Japanese Consumption Tax. It applies more or less to all goods and services that are bought and sold for use or consumption.

However since Airbnbs services means it is not classified as a hotel tourists staying in Airbnb accommodation do not have to pay the Tourist Tax much to the ire of the hotel industry in Malaysia which called for the service to be regulated. CIT is charged at a rate of 17 on the. You will be required to register your business with the Companies Commission of Malaysia CCM before carrying on business in Malaysia.

In the first year when you top-up your income with untaxed earnings from Airbnb and other types of side businesses you might need to save as much as 30 or 40 per cent of your new earnings for tax. Corbeil says things like property taxes mortgage interest any. How To Redeem RM100 Digital Voucher For Local Travel.

Malaysians and permanent residents of Malaysia are exempted from paying the tourism tax. But dont worry if your total income does not exceed VAT registration threshold which is 85000 for tax year 201718. Lets say you make 20000 net profit from your Airbnb in 2021.

28 June 2019. Tax forms for the United Kingdom are due by 31 January each tax year. Lastly the additional rate is 45 and applies to income of 150000 and above.

Digital vouchers of up to RM100 to all Malaysians for domestic tourism purposes to be enabled for Airbnb bookings. The main reason for any form of regulations is most definitely Taxation. If you make 5000 renting out your home thats an extra 5000 of income you need to report.

The amount depends on the total income you earn and the amount of tax deducted from your other income sources. He said the platform is exempt from the tourism tax imposed on the domestic hotel industry because Airbnb. MPC has proposed the industry to face the standard income tax for short-stay Airbnb operators plus SST.

The tax was enforced in September 2017 and is applicable to foreigners. Malaysian who travels domestically in 2020 will be eligible to receive RM100 worth of digital voucher per person. Income Tax Reporting by Airbnb.

Citing Teo the Malay Mail reported today that tourism tax imposed on the local four- and five-star hotels does not affect the US online. 12 July 2019. The higher rate is 40 and applies to income of 50001 to 150000.

Money from tourists staying in Malaysia is leaving the country through alternative online booking sites like Airbnb the Malaysian Association of Hotel Owners MAHO president Tan Sri Teo Chiang Hong said last night. Corporate Income Tax Rates. This voucher can be used on domestic flights and rail booking as well as hotel accommodations.

Airbnb is classified as a payment settlement entity and can report your income to the IRS depending on your account status and the taxpayer information youve submitted in case you earn more than 20000 and have more than 200 reservations in a year and send you a 1099-K tax form. However with more and more Malaysians listing their property as Airbnb hosts or as budget accommodation. The potential implementation of tourism tax on Airbnb properties in Malaysia is expected to follow the existing mechanism applied to hotels.

Schedule C Example. Malaysia is not benefitting from the taxes on short stay platforms like Airbnb because it is flowing out of the country said the the Malaysian Association of Hotel Owners MAHO president Tan Sri Teo Chiang Hong. The San Francisco-based home-sharing company is moving to finalize a deal with tax authorities which will apply a new tourism tax of 10 ringgit 2.

If youre just dipping your toe in the water the good news is that HMRC doesnt expect you to declare Airbnb or other property income if the total for the year is less than 1000. You will need to pay these taxes when you bring in more than 400 each year. If youre in a 20 income tax bracket you will have to pay a total of 7060 in tax.

CIT is charged at a rate of 24. Check with HM Revenue Customs to find out if you need to declare the amount you earn from hosting. If you earn between 47630 and 95259 then you would have to pay 205 on that 5000 or 1025.

Has agreed to work with Malaysia on tax collection with initial efforts to focus on a tourism levy as the government prepares to cast a wider net on the digital economy. In England the basic tax rate is 20 and applies to income of 12501 to 50000. As you may recall the special tourism tax relief that was announced under the Economic Stimulus Package 2020 originally for March to August 2020 had been extended up until.

This means you need charge VAT at 20 on the rent you charge your lodger. We have listened to local authorities and have. And if its in your own home then you can earn up to 7500.

For resident companies with paid-up capital of up to 25 Million MYR and gross income of less than MYR 50 Million. Airbnb falls within the definition of holiday accommodation and so standard rated. In general the money you earn as a Host on Airbnb is considered taxable income that may be subject to different taxes like income tax business rates corporation tax or VAT.

There is potential criminal liability such as financial penalties andor imprisonment for carrying on business under a business name without being registered in respect of that name. As many affected Airbnb hosts rely on booking income to. Thats a lot of tax for a rental so you want to avoid a Schedule C if possible.

KUALA LUMPUR July 2 Airbnb said today it welcomes Putrajayas proposal to tax its services along with other online firms but pressed for a fair structure amid growing scrutiny over the Singapore-based firms revenue. Yes of course we should have tax across the board Mike Orgill its South-east Asia Hong Kong and Taiwan. If you had booked a hotel or visited a tourist attraction in Malaysia during 2021 you could be eligible for an income tax relief of up to RM1000 on the expenses.

For 2020 self-employment has an Airbnb tax rate of 153 for the first 9235 of your income from self-employment. As such locals renting Airbnbs will. Airbnb has put forth a regulatory and tax framework for short-term rentals for consideration by the Malaysian government in an effort to create a sustainable ecosystem aimed at growing the countrys tourism industry and addressing local needs Bernama reported.

Corporate Income is taxed in Malaysia on the following rates. However if you earn more than this the short answer is yes HMRC does want to hear. You can find the full info regarding this voucher here.

Media Statement By Airbnb On Malaysia Budget 2022

Is Airbnb Rent A Tax Deduction For Digital Nomads Working Remotely

Rumah Teres Airbnb Listings In Malaysia Increasing Rapidly

How To Start Airbnb In Malaysia Airbtics Airbnb Analytics

How To Start Airbnb In Malaysia Airbtics Airbnb Analytics

Airbnb Guide To Investment Locations In Malaysia Property Investor Malaysia Investment Property

China In Focus Airbnb To Halt Listings In China After 2 5 Years Of Lockdowns Weighed Down Operations Arab News

Budget 2021 Airbnb Unveils Wishlist For Hard Hit Local Hosts

Airbnb Welcomes Tourism Tax For Short Term Accommodation

How To Know If The Location Of Your Property Is Suitable For An Airbnb Rental Quora

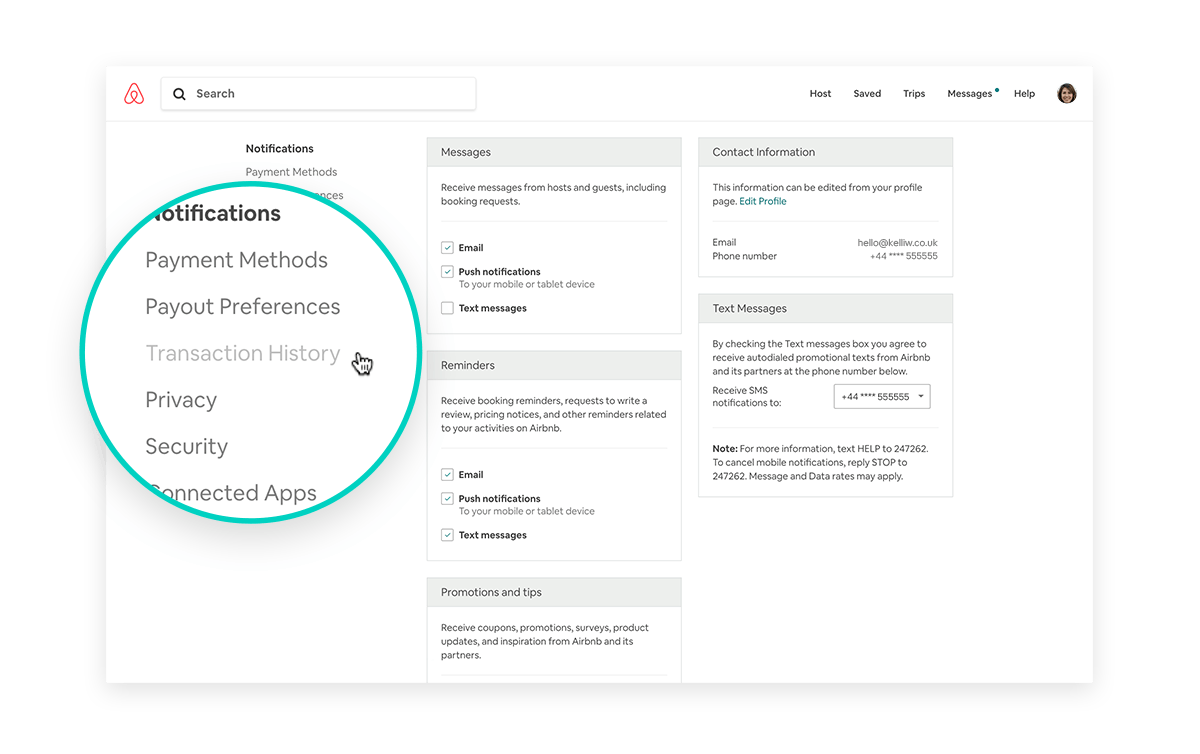

How To Find A Summary Of Your Airbnb Earnings

Key International Property Tax Filing Tips For Non Resident Airbnb Hosts

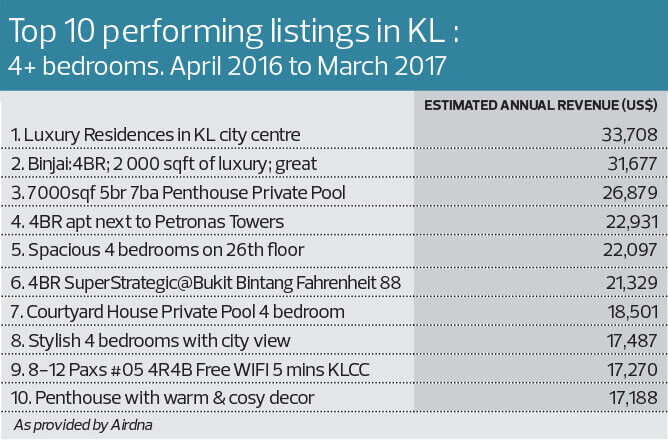

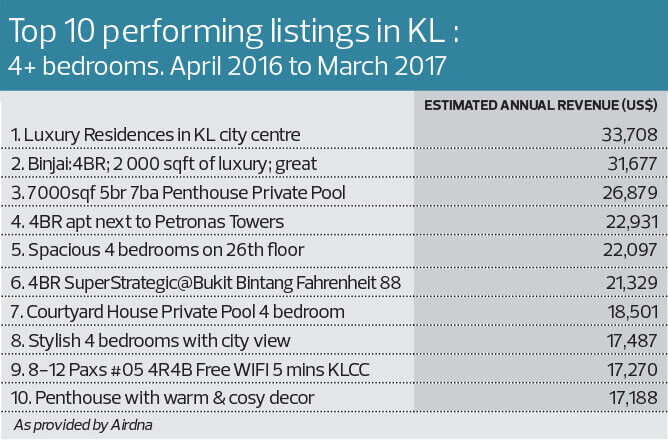

The Edge Malaysia How Much Do Airbnb Hosts Make In Malaysia Infographic Theedgemalaysia View High Resolution Or Download Https Www Theedgemarkets Com Article How Much Do Airbnb Hosts Make Malaysia For More Infographics Http Bit Ly

How To Check If Your Hotel Stay Is Eligible For The Tourism Tax Relief

Airbnb Welcomes Tourism Tax For Short Term Accommodation

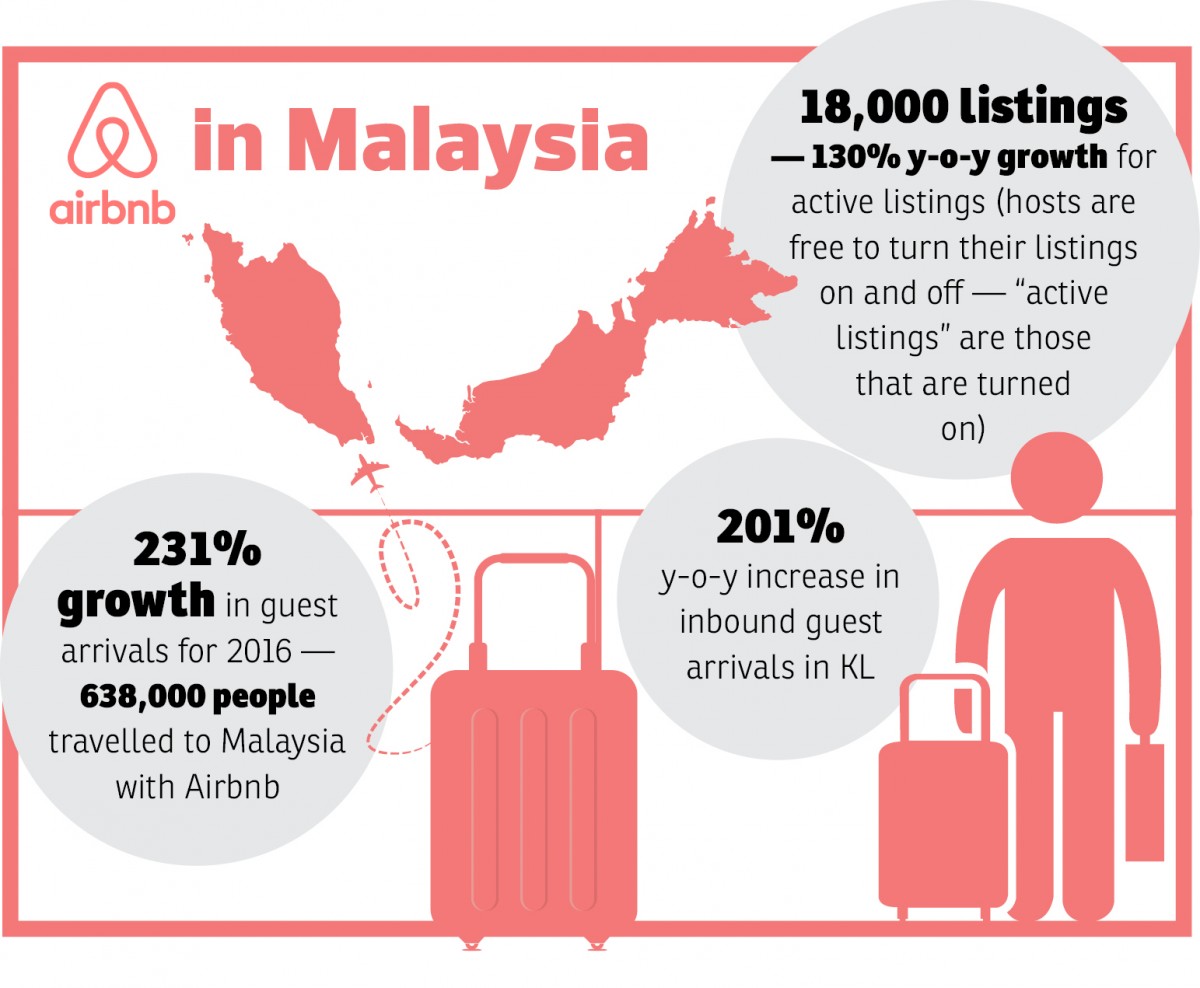

Airbnb Is Flourishing In Malaysia The Edge Markets

Airbnb Calls On Putrajaya To Consider Proposals To Aid Tourism Sector Businesstoday

What Depreciation Can I Claim When Owning An Airbnb

Media Statement By Airbnb On Budget 2021 Wishlist